How Credit Card Companies Get Away With Outrageous Interest Rates

Have you ever looked at your credit card statement and thought, “How on earth did I end up owing so much?” You’re not alone. Millions of people carry credit card debt, and thanks to sky-high interest rates, paying it off feels like climbing a mountain that never ends. But why are credit card interest rates so high? And aren’t there laws to protect us from this kind of thing?

Let’s break it down.

What Is Interest, Anyway?

When you use a credit card, you’re borrowing money from the bank. The bank doesn’t just lend you money out of kindness; they want to make a profit. That profit comes in the form of interest—a fee you pay for borrowing money. It’s usually shown as a percentage called the APR (Annual Percentage Rate).

Sounds fair, right? After all, businesses need to make money. But here’s the catch: many credit card companies charge interest rates of 20%, 25%, or even 30%!

How High Are Credit Card Interest Rates?

How High Are Credit Card Interest Rates?

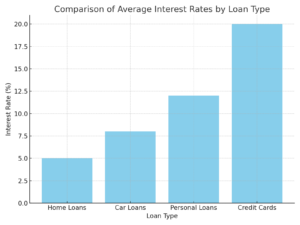

Compared to other types of loans, credit card interest rates are outrageously high. For example:

- Home loans typically have interest rates between 3% and 6%.

- Car loans usually range from 4% to 10%.

- Personal loans often have rates from 6% to 15%.

Meanwhile, the average credit card interest rate in the U.S. is around 20%. That’s way higher than other loans. Why is that?

Why Credit Card Interest Rates Are So High

Credit card companies argue that high interest rates are necessary because:

- Unsecured Loans: Credit cards are unsecured loans. This means there’s no collateral (like a house or car) that the bank can take if you don’t pay. Because they take more risk, they charge more interest.

- Defaults: Many people don’t pay off their credit card debt. When that happens, the bank loses money. To make up for those losses, they charge everyone else higher interest rates.

- Convenience: Credit cards offer a lot of convenience—you can buy now and pay later. But that convenience comes with a price.

While these reasons may seem logical, they don’t tell the whole story. The real reason credit card interest rates are so high is because they can be. And here’s where things get interesting (pun intended).

Aren’t There Usury Laws?

Usury laws are rules that set limits on how much interest a lender can charge. The idea behind these laws is to protect borrowers from being charged ridiculously high rates. So if there are usury laws, why are credit card companies allowed to charge 20%, 25%, or even 30%?

Here’s the loophole: most usury laws are set by states, not the federal government. Credit card companies figured out that if they set up shop in states with very weak or no usury laws, they could charge whatever they want. States like South Dakota and Delaware are famous for having very lax laws on interest rates.

When a credit card company is based in one of these states, they can issue cards to people all over the country and still follow the rules of that one state. That’s how they get away with it.

The History of High Credit Card Interest Rates

The History of High Credit Card Interest Rates

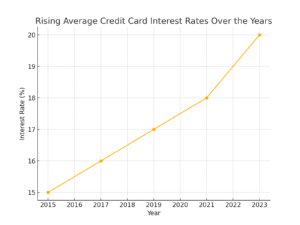

It didn’t always used to be this way. Back in the 1970s, most states had strict usury laws. But then came a big change.

In 1978, a Supreme Court case called Marquette National Bank of Minneapolis v. First of Omaha Service Corp. changed everything. The court ruled that national banks could charge the highest interest rate allowed in their home state, no matter where their customers lived. This ruling opened the floodgates, and banks started moving to states with little to no usury laws.

Once banks found these loopholes, credit card interest rates shot up. And they’ve been climbing ever since.

How This Hurts Consumers

High interest rates hurt consumers in many ways:

- Debt Traps: High rates make it almost impossible to pay off debt. If you only make the minimum payment, most of your money goes toward interest, not the principal (the original amount you borrowed).

- Financial Stress: Carrying high-interest debt can cause serious stress. People worry about how they’ll ever pay it off.

- Limited Options: With so many people in debt, it’s harder for them to qualify for other loans or mortgages.

The Economy and Credit Card Use: A Perfect Storm

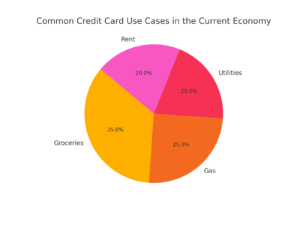

In recent years, the economy has forced many people to rely heavily on credit cards just to get by. With the rising cost of living, people are using credit cards for everyday essentials like groceries, gas, and even rent. Have you noticed how prices for basics like food have skyrocketed? Eggs that used to cost a few bucks now sell for as much as $9 a dozen in some places!

When incomes don’t keep up with inflation, many families have no choice but to turn to credit cards to cover the gap. But with high interest rates, that debt can quickly spiral out of control.

Lower-income families and people on fixed incomes are especially hard hit. Many retirees, living on Social Security or small pensions, find themselves swiping their credit cards just to afford basic groceries and utilities. What used to be manageable monthly expenses have turned into overwhelming debt burdens due to high interest rates.

The combination of rising prices and high credit card interest rates creates a vicious cycle:

- People use credit cards to cover basic needs.

- They can’t pay off the full balance.

- Interest piles up, making it even harder to pay off the debt.

- They end up using credit cards again, and the cycle continues

Political Attention on Credit Card Interest Rates

There may be some hope on the horizon. Recently, incoming President Donald Trump has mentioned that he plans to address the issue of high credit card interest rates. While the details are still unclear, the idea of political intervention has sparked hope for many consumers drowning in debt.

If the government steps in and imposes stricter regulations on credit card companies, it could provide much-needed relief for millions of Americans. However, whether such promises will translate into action remains to be seen.

It’s unfortunate that the government hasn’t already stepped in to help regular people, especially those on fixed incomes or struggling to make ends meet. They stepped in to help with student loans—so why not credit card debt? (We’ll save the student loan debacle for another article.)

Should the Government Step In?

Many people believe that the government should step in and regulate credit card interest rates. After all, they’ve stepped in to regulate other industries when things got out of hand.

One idea is to bring back stricter usury laws or create federal rules that limit how much credit card companies can charge. Another idea is to require more transparency so consumers understand exactly what they’re getting into.

But until that happens, it’s up to consumers to protect themselves.

Low-Interest Alternatives: What to Look For

If you’re searching for ways to borrow money without falling into the credit card trap, here are some alternatives to consider:

- Credit Unions: Credit unions often offer lower interest rates on loans and credit cards compared to big banks.

- Personal Loans: A personal loan from a bank or online lender may have a lower interest rate than your credit card.

- Buy Now, Pay Later Services: Some services let you split payments into smaller, interest-free installments. Just be careful to pay on time.

Credit card companies charge outrageous interest rates because they can. They’ve found loopholes in the system and are making billions of dollars off consumers who can’t afford to pay off their debt.

With inflation pushing up the cost of living, more people are being forced to rely on credit cards just to get by. But high interest rates turn that convenience into a long-term financial burden.

While we wait for lawmakers to catch up and close these loopholes, the best thing you can do is educate yourself. Understand how credit card interest works, take steps to reduce your debt, and avoid falling into the high-interest trap whenever possible.

It might feel like a battle, but with the right knowledge and tools, you can fight back against those sky-high rates. Remember, knowledge is power—and in this case, it might just save you a whole lot of money.